Preparing for Tax Season: Essential Numbers for Small Business Owners

YS

Tax season can be a daunting period for small business owners, but with the right preparation, the process can be much smoother. One of the key elements to an efficient tax season is having a good grasp of your essential numbers. Understanding these figures not only helps in tax filing but also provides insights into your business's financial health.

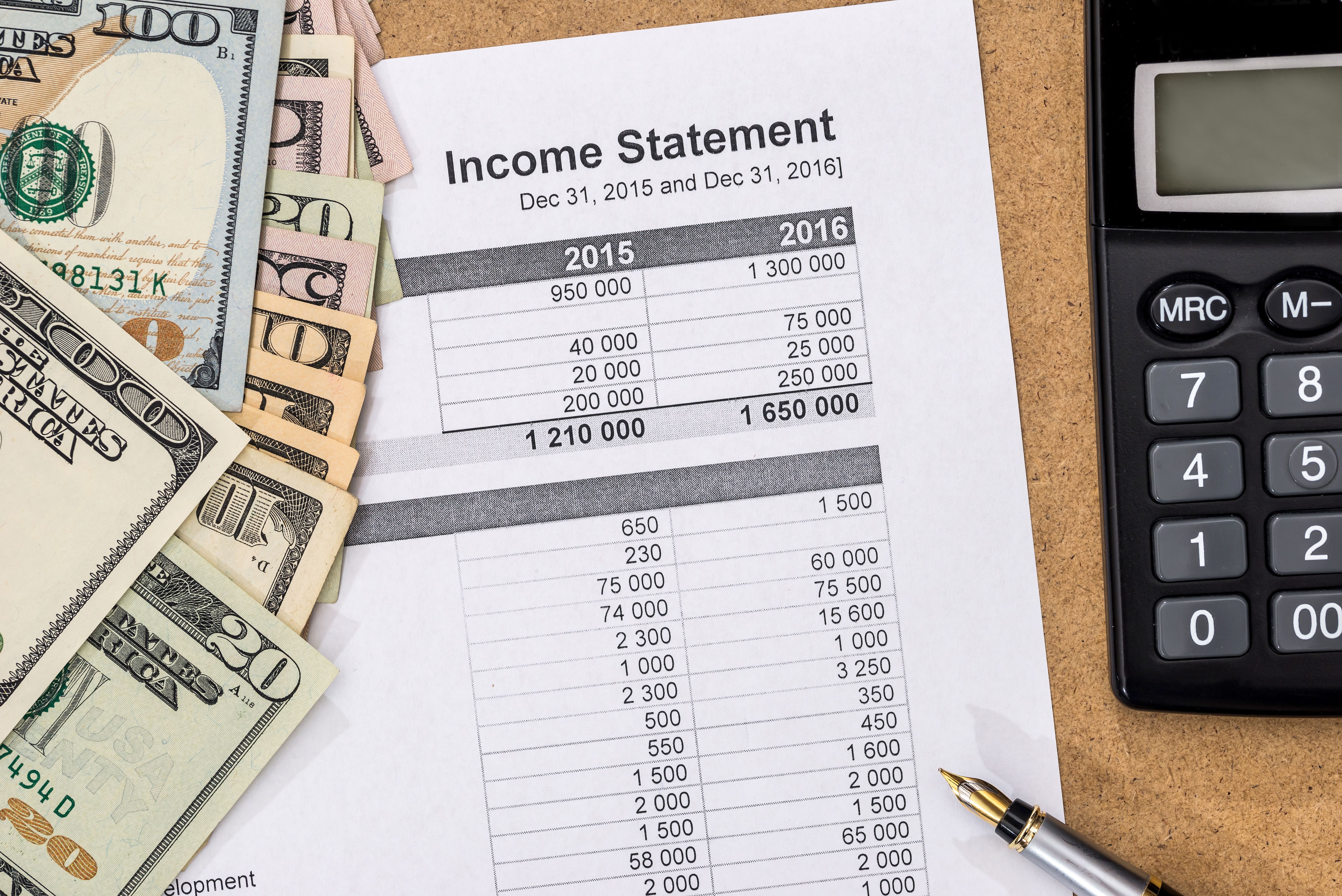

Understand Your Income Statements

Your income statement is a fundamental document that outlines your business's revenues and expenses over a specific period. It's important to review this statement regularly to ensure you have accurate information ready for tax season. This document will help you identify your total income, which is crucial when calculating your taxable income.

Track Your Expenses Diligently

Expenses can significantly reduce your taxable income, so it's essential to keep detailed records of all business-related expenditures. This includes everything from office supplies to utility bills. Consider using accounting software to easily categorize and track these expenses throughout the year, making your life easier when tax season arrives.

Don't forget to include expenses that might not be as obvious, such as mileage for business trips or costs associated with home office spaces if applicable. These can add up and provide valuable deductions.

Know Your Estimated Tax Payments

Many small business owners are required to make estimated tax payments throughout the year. These payments are typically due quarterly and are based on the income you've earned so far. Failing to make these payments can result in penalties, so it's crucial to keep track of them.

Keep Track of Employee and Contractor Payments

If you have employees or hire contractors, you'll need to report their earnings accurately. Make sure you have all necessary forms, such as W-2s for employees and 1099s for independent contractors, ready and sent out by the IRS deadlines. Keeping these records organized will prevent last-minute scrambles and ensure compliance with IRS regulations.

This also involves maintaining payroll records and ensuring all payroll taxes have been paid. Properly documenting these payments can protect your business from any potential disputes or audits.

Review Your Business Structure

Your business structure can impact how you file taxes. Different structures, such as sole proprietorships, partnerships, or corporations, have varied tax implications. Understanding how your business is classified and any associated tax benefits or obligations is crucial for accurate tax filing.

Consult a Tax Professional

While you might handle most of your financial tasks independently, consulting with a tax professional can be invaluable. They can offer tailored advice based on your specific situation and ensure you're taking advantage of all possible deductions and credits.

Tax professionals can also alert you to any changes in tax law that might affect your business. With their expertise, you can maximize efficiency and minimize stress during tax season.

Conclusion

Preparing for tax season doesn't have to be overwhelming if you stay organized and informed. By understanding and tracking essential numbers like income statements, expenses, estimated tax payments, and employee payments, small business owners can streamline their tax process. Don't hesitate to seek professional advice such as, The Abacus Whiz, to optimize your tax strategy and focus on growing your business.